The property market in Spain and house prices in 2025

Analysis of the year and real estate industry predictions for 2025

The Spanish real estate market has always been a subject of keen interest for investors, homeowners, and economists. As we enter 2025, the property market landscape is poised for shifts influenced by global economic trends, political policy changes, and ever-evolving buyer preferences.

For the new year, experts predict that the price of housing in Spain will continue to rise, driven by several factors, such as the continued low supply, expected falls in interest rates, moderate inflation and the increase in the population due to the arrival of affluent investors with the purchasing power to buy properties in Spain.

In this article, we'll explore the expected developments in house prices, mortgage rates, and other key trends shaping Spain's real estate market in the year ahead.

What will happen to Spanish house prices in 2025?

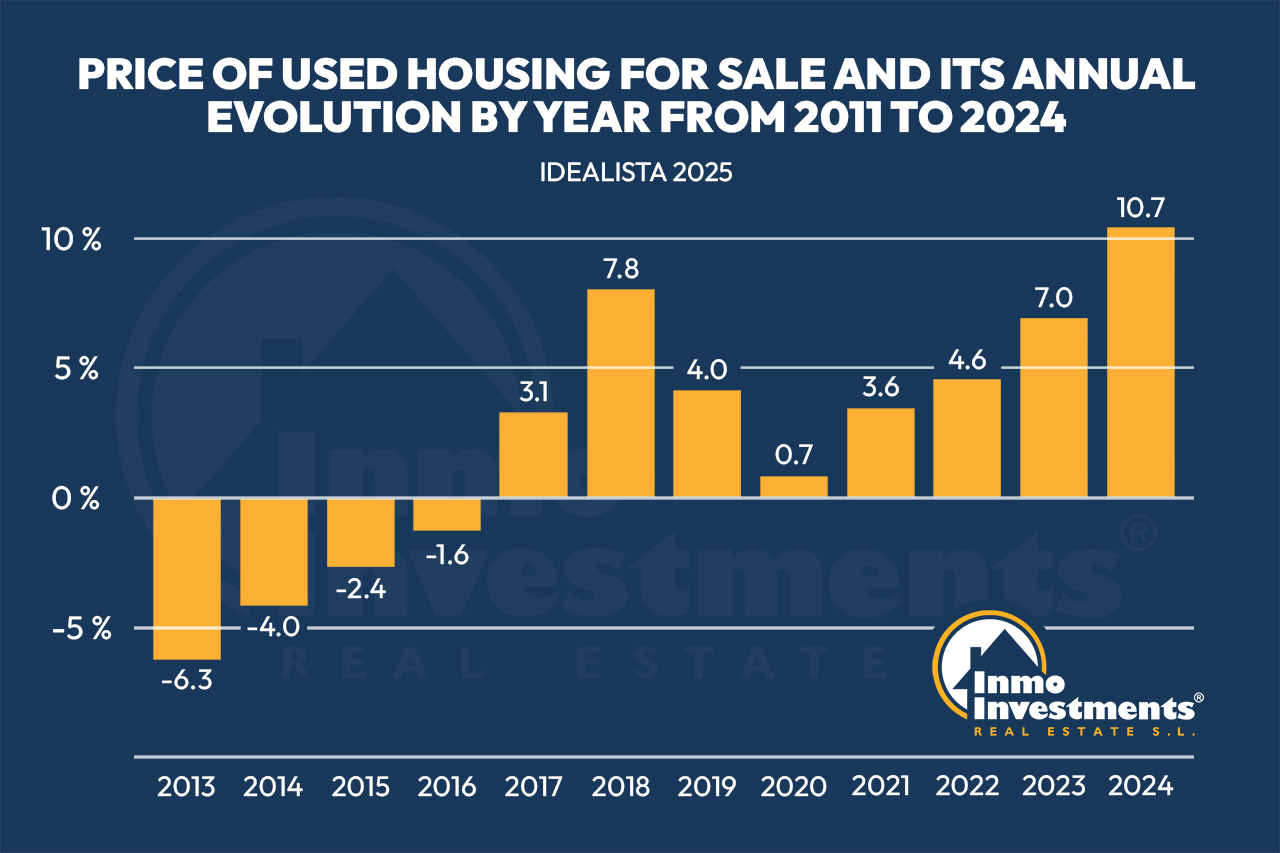

According to the latest available industry data, the housing market has shown a notable increase in house prices during 2024. Nationwide, resale house prices finished the year with a year-on-year increment of 10.7% to 2.244 €/m2 in November, marking the biggest rise since 2006 and adding seven consecutive months of price increases.

House prices in Spain are projected to experience moderate growth in 2025. After years of robust recovery, experts suggest that the market is entering a stabilisation phase.

Nonetheless, according to a recent forecast from Bankinter, house prices are expected to rise by approximately 5% nationally, with regional variations that favour major city locations and popular coastal areas.

Fotocasa, Spain's leading property portal, predicts that house prices in Spain will rise by between 5% and 8% next year, whilst industry specialists Idealista agree, with an upward movement in property prices by 5% to 7%.

Caixabank strikes a more conservative approach forecasting nominal price increases of around 4%, citing the nationwide affordability of housing as a limiting factor in future price growth during 2025.

Urban areas such as Madrid, Barcelona, Alicante and Valencia will likely see higher price increases due to strong demand, limited supply, and continued interest from international buyers.

Property prices on the Costa Blanca in 2025

Coastal regions such as the Alicante Province and the Balearic Islands will also experience steady growth, fueled by tourism and the demand for holiday homes. However, rural areas further away from the coast may see slower appreciation as urban migration trends persist.

Costa Blanca and Orihuela Costa are expected to see sustained interest from international buyers, particularly from Northern Europe.

House prices in Costa Blanca are forecast to grow in line with industry expectations, with Orihuela Costa benefiting from its reputation as a hub for international residents and retirees.

The demand for properties in Orihuela Costa is bolstered by a mix of affordable traditional housing and new luxury developments catering to different buyer profiles and nationalities.

Will mortgage rates continue to decline in 2025?

Mortgage rates are anticipated to remain a focal point for buyers in 2025. Over the past few years, rising interest rates across Europe have placed upward pressure on mortgage costs.

However, the European Central Bank (ECB) is expected to adopt a more cautious approach to further rate hikes, given concerns about economic growth.

Falling interest rates and strong commercial competition in banking are predicted to improve financing conditions and the number of mortgages granted is expected to increase, even though the lack of supply will continue to put upward pressure on house prices.

Fixed-rate mortgages are expected to become more popular as buyers seek stability amid potential economic fluctuations and average Euribor rates are anticipated to continue falling to around 2% or 2.5%.

For prospective buyers, careful consideration of mortgage terms will be critical to navigating the changing landscape.

What factors will shape the Spanish property market in 2025?

Demand: Spain remains a hotspot for foreign investors, particularly from the UK, Germany, and other cooler climes in northern Europe. Favourable exchange rates and Spain's evergreen appeal as a holiday home destination will continue to attract international buyers during the forthcoming year.

Accessibility: The Costa Blanca and Orihuela Costa, in particular, stand out as preferred destinations for international buyers. Excellent flight connections from regional airports to both Alicante and Murcia airports combined with a modest travel time, means properties in these areas will continue to find favour with investors from abroad.

Government policies: The Spanish government’s ongoing initiatives to boost affordable housing supply and curb speculative buying are expected to play a significant role. Tax incentives for first-time buyers and stricter regulations on short-term rentals in urban areas might impact demand dynamics.

Remote work trends: The shift toward hybrid and remote working models will sustain demand for properties in coastal areas, where buyers will continue to find a broad spectrum of properties at relatively affordable prices compared with other destinations in Southern Europe.

The rental market: While the Spanish domestic rental sector still reels from the perfect storm of rising demand, rising rental costs, and constricting supply, the demand for holiday home rentals is expected to remain strong.

Stricter rules on short-term tourist rentals may limit new rental properties coming to market, reducing supply and placing upward pressure on rental prices in Mediterranean coastal locations.

The rental market in Costa Blanca and Orihuela Costa is particularly dynamic, driven by seasonal demand from tourists and visitors. Property owners offering well-located, seasonal tourist rentals are likely to see high occupancy rates and competitive yields during 2025.

New construction trends: Property developers continue to face challenges such as rising costs, a lack of available building land, and a constrictive administrative burden at all levels of government that impedes the delivery of new homes.

This lack of new development is expected to apply upward pressure on the resale market, increasing demand for resale properties and boosting house prices.

The local property market in Orihuela Costa

Our overall performance in 2024 showed a steady increase in the second and third quarters, highlighting strong market engagement with international buyers in Orihuela Costa.

Our sales team sold 6% more properties in 2024 than in the previous year reflecting an overall positive trend in client acquisition and sales conversions, and we expect this trend to continue into 2025.

British buyers continue to dominate the local market, accounting for 17.5% of our local sales in 2024. German buyers accounted for 15.5% of our buyers, followed by Irish property buyers (9.7%), Swedish (6.8%), Belgian (6.8%), Spanish (2.9%), and Polish buyers (1.9%).

In total, we represented the interests of 18 different nationalities over the past year, and we expect these local trends to continue in 2025 in the Orihuela Costa and South Costa Blanca areas.

The Spanish real property market in 2025 offers a mix of opportunities. Strong but stable price growth, evolving buyer preferences that favour coastal locations, and increasing demand are expected to shape the market's trajectory over the forthcoming year.

Interested in investing in Spanish property in 2025? This luxury second-line villa in prestigious La Zenia offers generous accommodation with 7 bedrooms and 3 bathrooms, a spacious terrace, and a south-facing garden with a private swimming pool. Just 100 metres from the beach, tap here to view the property listing.

Previous

Previous